Your fund admin. Your way.

Managing any fund is complex. Whether you’re an established fund or you’re looking to launch a new fund, expanding your investor network or entering into new jurisdictions, you’ll face even greater complexity. Coping with new regulations and operational challenges, along with unfamiliar investor relations, is time-consuming and labour-intensive.

Vistra’s fund administration services reduce your administrative burdens and enhance your operational efficiencies. We act as an extension of your back office, providing fund accounting and reporting (including ESG reporting), investor reporting and regulatory and compliance services. And we’re flexible, so you choose only the services you need.

Plus it's all kicked off with a seamless onboarding process, so you can focus on what you do best – maximising your investments.

Or find out more below.

Benefits of Vistra’s fund administration services

Our technology gives you control

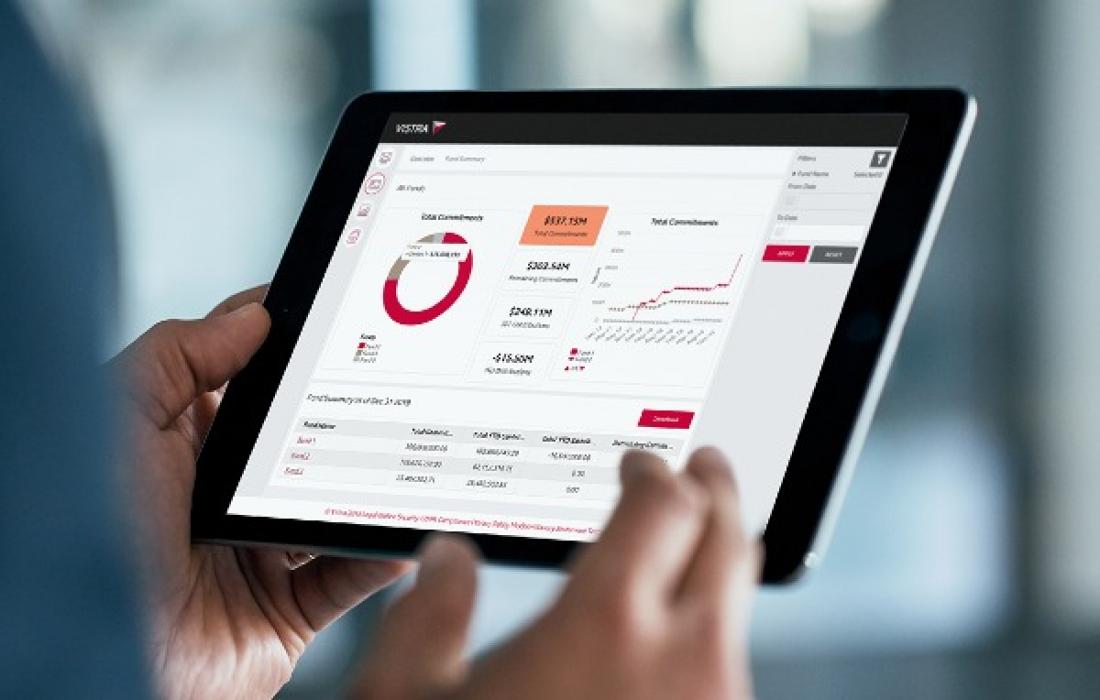

With investors and investments located around the world, you need effective solutions to help you manage it all, wherever you are. That’s why technology is a critical part of our fund admin services. From customisable dashboards that integrate with Investran, showing your investments’ performance, to holistic views of your regulatory and compliance obligations, our Vfunds and GCA platforms give you complete control over your funds.

Purposeful investing: ESG compliance, due diligence and beyond

Our fund administration insights

Why Vistra for fund administration services

Our fund administration services

*USD - United States Dollars

Contact us

Meet the Team

- 5,000 Professionals

- 85+ Offices

- 45+ Jurisdictions

c2a4.jpg?itok=X7KR6WX8)